Presented On US Sports Net By WNFC Marketing

Formula E, UFC and eSports are giving rise to a raft of lucrative sponsorship opportunities for brands that get involved early.

The summer of sport is well and truly underway, with the UEFA Euro tournament kicking off in France last week and the Super Bowl and the Olympics both firmly on the horizon. But amid a period of unprecedented sporting scandal and the emergence of new broadcast platforms and fan communities, it is certainly not business as usual for the average sports marketer.

The Women's National Football Conference Kicks Off 2019! Get On Board Today!

Football (Soccer), tennis and athletics have faced allegations of corruption and doping over the past year, with investigations ongoing in all those sports. At the same time, many young fans are making the move to newer, alternative sports that better chime with their values and offer deeper levels of digital engagement. Brands could be missing out if they fail to pay attention to these emerging sports and the sponsorship opportunities they present.

This year’s Cannes Lions International Festival of Creativity, which began on 18 June, is hosting its first ever Lions Entertainment event, which will look at all forms of audio-visual entertainment including live experiences, gaming and sport. Cannes senior content manager Mark St Andrew believes one of the big talking points at the event will be the increasing importance of “co-creation and collaboration” between sponsors, athletes and fans.

He says activity is rarely “just a simple tactical transaction” anymore and that marketers are increasingly integrating sports into their broader campaigns, often featuring elements of gaming, music and live events.

As established, ‘traditional’ sports face the challenge of retaining and growing their fan base, certain brands are developing alternative sponsorship strategies in an array of newer sports. Marketing Week looks at three of the most exciting emerging sports – Formula E, UFC and eSports – and the potential opportunities they present to marketers.

Formula E

Launched in September 2014, Formula E aims to bring a new audience to motor sport by championing electric vehicles and sustainability. Although the cars are not as powerful as their Formula One counterparts, they can reach speeds of up to 140mph, while the clean technology and low noise emitted by vehicles makes them suitable for city centre racing.

Despite its early stage of development, Formula E, which like Formula One is backed by motor sport governing body the FIA, already has global partners on board, including Tag Heuer, DHL and Visa. The championship has also encouraged brands to get involved in creating new racing teams. Last year, business-to-business insurance company Amlin agreed a partnership with racing group Andretti to create one such team.

Amlin’s global communications director Adrian Britten explains that the company was drawn to Formula E after looking for a sponsorship asset with global reach that would align with its brand values around sustainability. He notes, for example, that innovations in Formula E are geared towards developing electric car technology that can be used in everyday settings.

“We’re a business insurer and a reinsurer, so our interests are about the long-term sustainability of the economic and social system and the businesses that we provide insurance for,” says Britten. “[Formula E] is urban, electric and is about sustainability and clean racing, so it fits with our long-term perspective and our views on helping businesses to continue into the future.”

London’s Battersea Park will host the final race of the second season of Formula E on 3 July, which has already seen teams travel to Beijing, Buenos Aires, Paris and Berlin for this year’s 10-race season.

Formula E positions itself as a family-friendly alternative to Formula One, as events are easier to get to and tickets are cheaper. Additionally, races are restricted to one hour, meaning practice, qualifying and the race all take place in one day unlike the three-day duration for each Formula One race.

At present, the sport is broadcast in more than 190 territories, with ITV4 showing races live in the UK. However, its global fan base is comparatively small, with around 217,000 fans on the official Formula E Facebook page and 90,000 followers on Twitter.

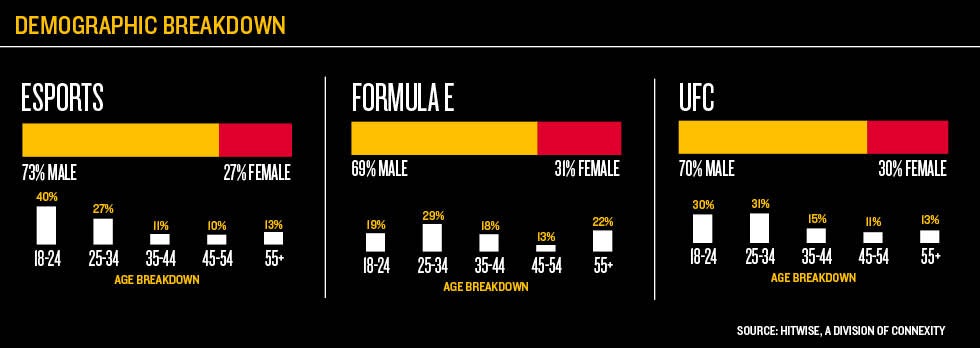

Data generated for Marketing Week by Hitwise, an online monitoring and profiling service and a division of Connexity, shows that UK fans of the sport are relatively spread out in terms of age, with 29% aged 25 to 34 and 22% aged 55 and over (see Demographic breakdown, page 23). Most fans (69%) are male and their favoured websites include those related to cycling equipment, outdoor gear and technology products.

Amlin is using the sponsorship to support its corporate hospitality programme, but its position as a 50-50 partner with Andretti also allows it to generate exclusive content that it can share on digital channels. Insurance analysts within Amlin even provide tools to help the racing team analyse data from its car. Britten claims that this level of integration is much more effective than a badging exercise.

“[Brands] might want to spend large sums on Formula One, putting a logo on a car and watching it whizz round, but I would question as a marketer why in this day and age you would do that,” he says. “Today, people want dialogue and conversation – they want to be involved and engaged with the racing team and what it’s doing.”

Like all emerging sports, Formula E is not without its teething problems. This year will be the final year that a race is held in Battersea Park after nearby residents complained about the disruption caused and brought a judicial review. Organisers are exploring new sites in London for next season’s race.

UFC

It is a measure of the rising popularity of Ultimate Fighting Championship (UFC), the leading sports brand for mixed martial arts (MMA), that it increasingly appears within the sport sections of mainstream media outlets. Earlier this month, several UK newspapers reported that Michael Bisping had become the first British champion of the US-based competition – a significant milestone in the brand’s ongoing global rise.

UFC was founded in 1993, but it has grown quickly in recent years thanks to TV and media rights deals that broadcast the sport in more than 150 countries. The brand has also gained a strong following on social media among a generation of young fans that appreciate the competitive – and often brutal – nature of the sport and the authenticity of its athletes when compared to the pampered, highly paid players that feature in other sports. UFC has more than 19 million Facebook fans and nearly 4 million followers on Twitter.

The UK has hosted several UFC events across the country, while BT Sport has the rights to broadcast it live. The media brand reports that its biggest audience to date for a UFC event was 330,000, with an average audience of 154,000, up 40% year-on-year. BT also says that UFC “has the youngest audience of all the sports broadcast on [its] channels” and attracts advertisers, such as bookmakers, car manufacturers and gaming companies, which are interested in targeting men aged 16 to 34.

Data from Hitwise shows that 61% of UFC fans in the UK are aged 18 to 34, while 70% are male. It finds that these fans are particularly likely to visit websites about bodybuilding, fitness and sports clothing.

James Elliott, EMEA vice-president at UFC, believes the competition reached a “tipping point” in the UK last year thanks to the emergence of “star fighters” and the brand’s use of digital channels to grow its fan base. Its female audience is also growing quickly due to the popularity of female fighters such as Ronda Rousey and Joanna Jędrzejczyk.

“Our fans feel a connection to our athletes, which is unrivalled in any other sport,” he claims. “That is a conscious effort and decision by the company to give access, tell stories and promote personalities.”

UFC has five sponsors in the UK – EA Sports, Monster Energy, Reebok, Harley-Davidson and AB InBev – and between 10 to 15 sponsors globally at any one time. Motorcycle brand Harley Davidson was one of the first backer of UFC, becoming a sponsor in 2007. It renewed its sponsorship for another three years in March this year (see Q&A, below).

However, for all its recent growth, UFC faces challenges with its public image that may hinder its ability to attract more sponsors. The behaviour of some of its athletes has generated controversy. For example, Bisping was forced to apologise following his recent title win for using a homophobic slur towards his opponent. MMA as a sport has also come under scrutiny over safety concerns. In April, a fighter died after being knocked out in a rival MMA competition, Total Extreme Fighting.

A spokeswoman for UFC said the organisation advises athletes on their conduct and that it would “look into the situation” of Bisping’s comments and “take appropriate action”. On the safety issue, she said: “Our priority has always been the health and safety of our athletes.”

eSports

Competitive online gaming, known as eSports, has grown rapidly in recent years thanks to the enthusiasm of its young and highly engaged audience. Its rise has coincided with the development of streaming technology and online forums that enable video game players to communicate and compete with one another. This has culminated in the emergence of a highly organised and competitive sport in which players can compete for big prize money – last year, winners of a tournament took home a share of $18m (£12m) – while fans around the world can watch the in-game action live online.

According to the latest Global eSports Market Report by research firm Newzoo, there are an estimated 148 million eSports enthusiasts globally, plus a further 144 million occasional viewers, meaning those who watch eSports less than once a month and mostly tune in for a big event. The report predicts the eSports market will grow 43% this year to reach $463m (£318m), and by 2019 it is expected to hit $1.1bn (£775m).

Upon relaunching its MLG.tv eSports platform last month, gaming giant Activision Blizzard told Marketing Week that brands should consider investing as much ad spend in eSports as they would in Premier League football.

The audience for eSports skews heavily towards younger people, according to the Hitwise data, with 40% of fans aged 18 to 24 and 27% aged 25 to 34. Three-quarters (73%) are male, while their favoured websites include other gaming sites, fashion outlets and online retailers such as eBay.

Sponsorships and brand partnerships are helping to accelerate the growth of the sport

in the UK. Last year, eSports company Gfinity launched the UK’s first dedicated eSports arena at Vue cinema in Fulham Broadway, London. The 600-seat Gfinity Arena hosts live tournaments every weekend and on selected weekday evenings, with all events streamed live online.

in the UK. Last year, eSports company Gfinity launched the UK’s first dedicated eSports arena at Vue cinema in Fulham Broadway, London. The 600-seat Gfinity Arena hosts live tournaments every weekend and on selected weekday evenings, with all events streamed live online.

Brands interested in the sport have the option of sponsoring at a league or competition level, as well as a team level. Spanish team G2 Esports, which competed in the recent ESL Pro League Finals at Indigo at the O2, is sponsored by Vodafone, for example, meaning the players wear team shirts that display the company logo. Gambling brand PokerStars, meanwhile, sponsors an eSports franchise called Team Liquid.

Competitive gaming network FaceIt and Amazon-owned video platform Twitch have also partnered to launch the Esports Championship Series, the final of which will take place at

The SSE Arena, Wembley on 25 and 26 June.

The SSE Arena, Wembley on 25 and 26 June.

Rick Fox, a businessman and former NBA basketball player, launched his own eSports franchise last year. He believes potential sponsors are showing increasing levels of interest in competitive video gaming. The franchise, Echo Fox, recently hired marketing agency VFD eSports to help it grow its sponsorship deals.

So far, it has tie-ups with brands primarily associated with eSports such as Vertagear, a company that makes specialist chairs for video gaming. However, Fox claims the franchise is in talks with a number of big-name consumer brands. “On a day-to-day basis, we’re in conversations with companies that you would see in traditional sporting leagues and franchises that you recognise,” he says. “That includes phone, electronics and beverage companies.”

Fox decided to get involved in eSports out of his own love of gaming and his desire to reimmerse himself in a competitive environment, following the end of his basketball career. As a three-time NBA champion with the Los Angeles Lakers, Fox has been able to use his celebrity profile to recruit gamers and raise awareness of his teams. This also involves building the Echo Fox brand by working with eSports leagues and streaming platforms, and by creating team merchandise for sale to the general public.

Fox believes brands that build a presence in eSports now will be well set for the future. “The beauty of the industry is that as leaders and early adopters in this space, you can start to carve out opportunities for yourself,” he says. “It is as creative as you are capable of being.”

No comments:

Post a Comment